Posted on: Friday, December 9, 2022

Price moderation and a sales slowdown are likely over the coming months but should be considered in the context of economic history, the frenzied post-pandemic market and the longer-term outlook.

The market in context

The Autumn Statement provided a sobering assessment of the UK economy, but forecasts for the housing market are less dramatic than during 1989–1993 and the Global Financial Crisis in 2007/8. Inflation is expected to peak during the final quarter of 2022 before falling back over the course of 2023, and unemployment looks likely to remain lower than the 10-year average (5.3%). The Global Financial Crisis, caused by banks lending more than borrowers could afford to pay, led to the more stringent mortgage lending criteria imposed since 2014. Today, only an estimated 4.2% of homeowners have less than 10% equity in their home.

Price correction

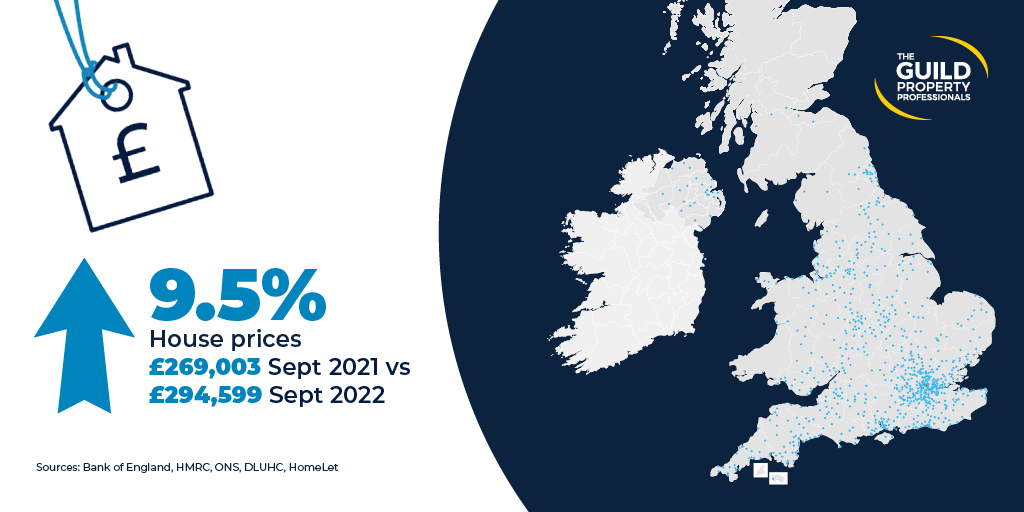

Property price growth is moderating and price correction is forecast. At 7.2% in the year to October, annual price growth remains considerably stronger than the 3.3% average between 2010 and 2019. Since June 2020, average property prices have risen by close to £50,000, the equivalent of 24%, with lockdown and lifestyle changes spurring the market. Single-digit price correction is predicted for 2023/2024 before price growth is anticipated to return in 2025. Buyers will continue to benefit from the 0% rate of stamp duty up to £250,000 until March 2025. With almost one in three movers ‘needs-based’, such buyers will present sales opportunities.

Rises and cuts

The Autumn Statement confirmed a raft of spending cuts across Whitehall and tax rises through changes and freezes to tax thresholds. At 5.7% in the year to September, wage growth is at its fastest in over 20 years, but the conflict in Ukraine continues to impact energy costs and food prices, and a package of measures remains to support the most vulnerable. Expectations for interest rates, gilts and swap rates are up to 1% better than in the immediate aftermath of the ‘Growth Plan’, although mortgage rates of 5% to 6% will be usual for those seeking to purchase or remortgage.

Lettings

Demand for quality rental housing continues across the UK. A shortage of stock and additional demand from prospective buyers, who may well rent in the short term as opposed to buy, continues to fuel prices. Average rents in the UK rose again in October to £1,171. Excluding London, average monthly rents now stand at £976. Annual rental growth in Scotland has doubled in the past year, with emergency legislation passed by the Scottish Government to freeze rents and evictions for both the private and social rented sectors until at least 21 March 2023.

Regional Reports

Browse our Regional Market Reports:

● Market Report 2022 Winter East Midlands

● Market Report 2022 Winter Essex, Norfolk and Suffolk

● Market Report 2022 Winter Hertfordshire, Bedfordshire and Cambridgeshire

● Market Report 2022 Winter London

● Market Report 2022 Winter North East, and Yorkshire and The Humber

● Market Report 2022 Winter Northern Ireland

● Market Report 2022 Winter Scotland

● Market Report 2022 Winter Devon and Cornwall

● Market Report 2022 Winter Southern Home Counties

● Market Report 2022 Winter South East Home Counties

● Market Report 2022 Winter Southern

● Market Report 2022 Winter Thames Valley

● Market Report 2022 Winter West England

● Market Report 2022 Winter West Midlands

● Market Report 2022 Winter North West

● Market Report 2022 Winter Wales

Contact us today

To see a full copy of The Guild’s winter market report and for further guidance on the home moving process, take a look at the regional property market updates or get in touch with your local Guild Member today.

Recent News

Discover the inside homes difference...

At Inside Homes, we are proud to be Estate agents in Warwickshire who deliver comprehensive property sales and marketing services with unwavering professionalism and integrity. We understand the journey you're on because we've walked in your shoes.

Find out more

How Much is Your Property Worth?

Not sure how much your property is worth? Request a free, no obligation valuation for your property.

Book a valuation